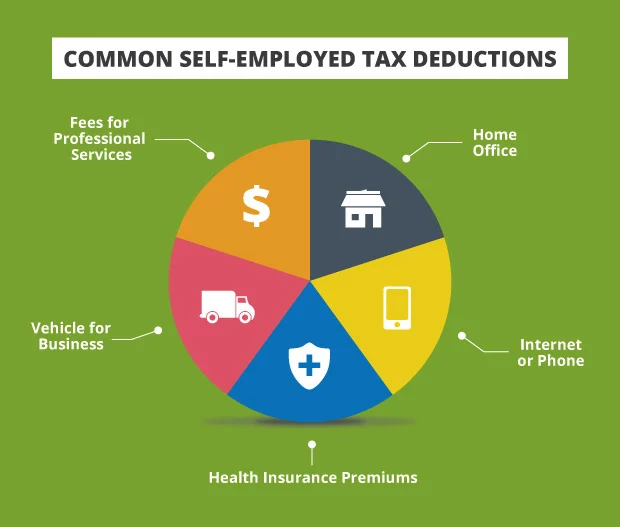

Being self-employed comes with many perks, but it also means navigating the world of taxes a bit differently. If you’re a self-employed individual looking to reduce your tax liability, there are various deductions you can consider. Keep in mind that this information is not legal advice but rather some useful tips to explore potential deductions that could help you save on taxes.

Home Office Deduction

If you operate your business from a home office, you may be eligible for the home office deduction. To qualify, your home office should be used exclusively and regularly for your business. Calculate the percentage of your home’s total square footage that your home office occupies, and you can deduct that percentage of your home-related expenses, such as utilities and rent/mortgage interest.

Dues and Fees

Dues and fees related to your profession or industry can be deducted from your self-employed income. This includes:

- Dues to professional organizations

- Union dues and assessments

- Regulatory fees

- Licenses paid to state or local governments

Books and Publications

Expenses related to books, trade journals, newspapers, and publications directly relevant to your trade or profession can be deducted.

Education and Research

If you invest in education or research that enhances your skills or is directly related to your current work, these expenses can be deductible.

Equipment and Supplies

Business-related equipment and supplies can be deducted. This includes computers, tools, and other items necessary for your work. Keep in mind that certain limitations may apply, so consult with a tax professional for guidance.

Meals and Entertainment

Self-employed individuals can deduct 50% of the cost of meals and entertainment expenses incurred while conducting business. Keep accurate records, including receipts and documentation of the business purpose.

Travel Expenses

If you travel for business purposes, you can often deduct expenses such as airfare, accommodations, meals, and even mileage. Ensure that these expenses are directly related to your business activities.

Self-Employment Tax Deductions

Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. However, you can deduct the employer portion of these taxes when calculating your adjusted gross income.

Losses from Multiple Businesses

If you run multiple businesses and one incurs losses while the other is profitable, you can use the losses to offset the income from the profitable business, potentially reducing your overall tax liability.

Keep Detailed Records

Regardless of the deductions you plan to claim, it’s crucial to maintain meticulous records of all expenses, receipts, and relevant documentation. This will help you substantiate your deductions in case of an audit.

Remember that tax laws can be complex, and eligibility for deductions may vary based on your specific circumstances. It’s advisable to consult with a tax professional or accountant who specializes in self-employment to ensure you’re maximizing your deductions while remaining in compliance with tax regulations.

Save money on taxes and enjoy the benefits of being self-employed with these deduction opportunities!

if you want to learn more about making money, visit RichMoneyMind.com

If you want to learn more about laws, like tax deducations, visit LegalKnowItAll.com

As an Amazon Associate we earn from qualifying purchases through some links in our articles.